New Year, New Payment Amount? Escrow Statements Explained

January 28, 2025

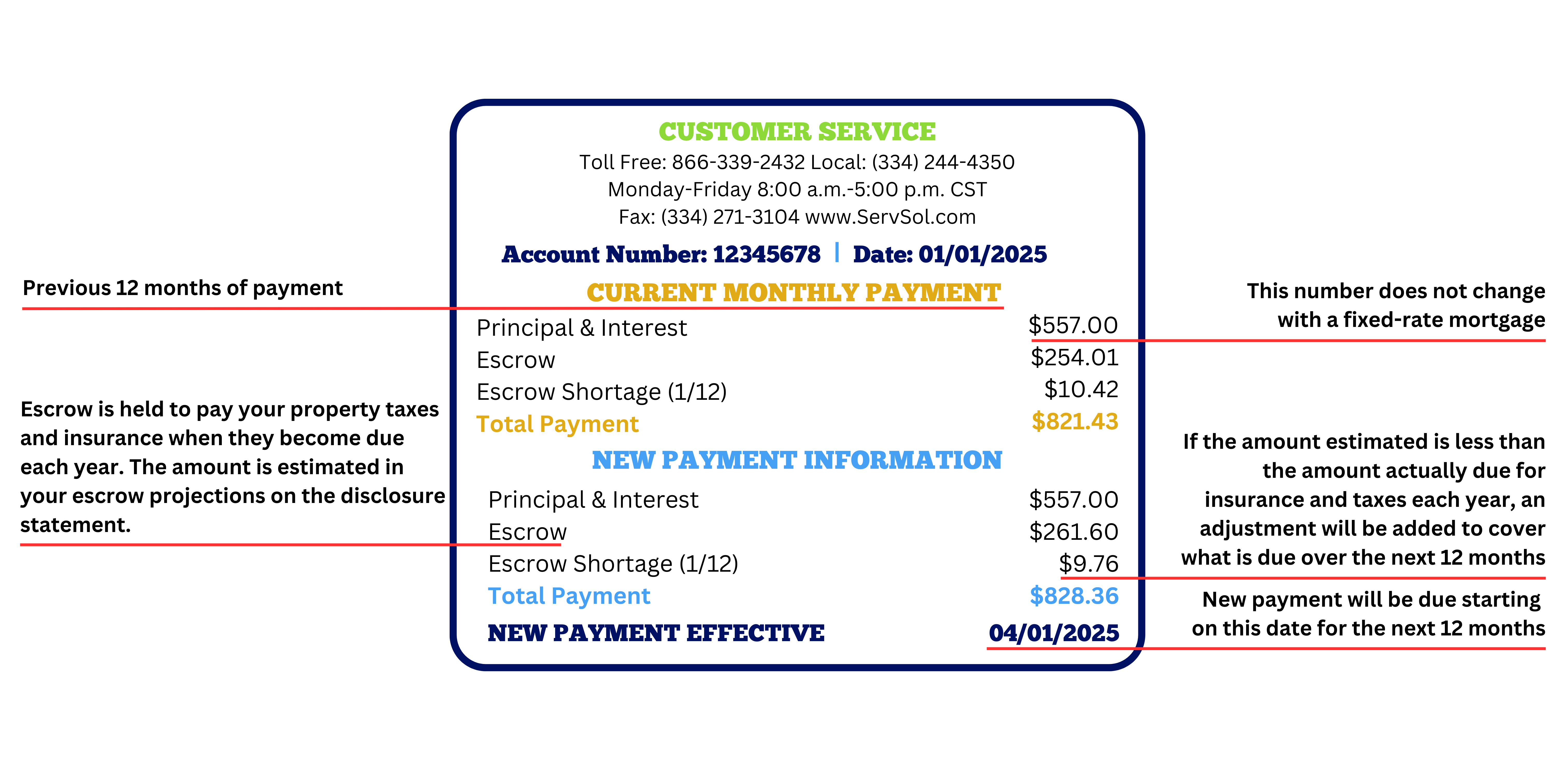

Each year we mail an escrow summary, called an “Annual Escrow Account Disclosure Statement,” to every ServiSolutions borrower to break down the details of your monthly mortgage payment. The timing of this statement depends upon when property taxes are due in the state where you live.

You may have seen the acronym “PITI” before. That stands for Principal, Interest, Taxes, and Insurance. The PI part (principal and interest) does not change each year with your fixed-rate mortgage. But the TI part (taxes and insurance) may change a little bit. That change does not come from ServiSolutions, but from your state and local government (taxes) and your insurance company (insurance). Like most other mortgage servicers, ServiSolutions simply updates the estimated amounts required for your taxes and insurance for the coming year, so that these bills will continue to be paid on your behalf. That money is held for you in an escrow account.

In the statement we show you your new payment amount that includes this change. If your taxes and insurance decrease, so that you have overpaid by more than $50 based on last year‘s estimates, then we will send you a refund check for the difference. If your taxes and insurance increase, so that you are likely to owe more in the year ahead, your statement will reflect a higher estimated amount. You can pay your shortage all at once for the whole year, or just pay 1/12 of it each month in your new mortgage payment.