Sailing the 5 C's of Credit: How Loan Decisions are Made

March 20, 2024

Because March is National Credit Education Month, we thought you might like to see some of the factors that lenders considered before making your mortgage loan — and how you might be evaluated for any future loans.

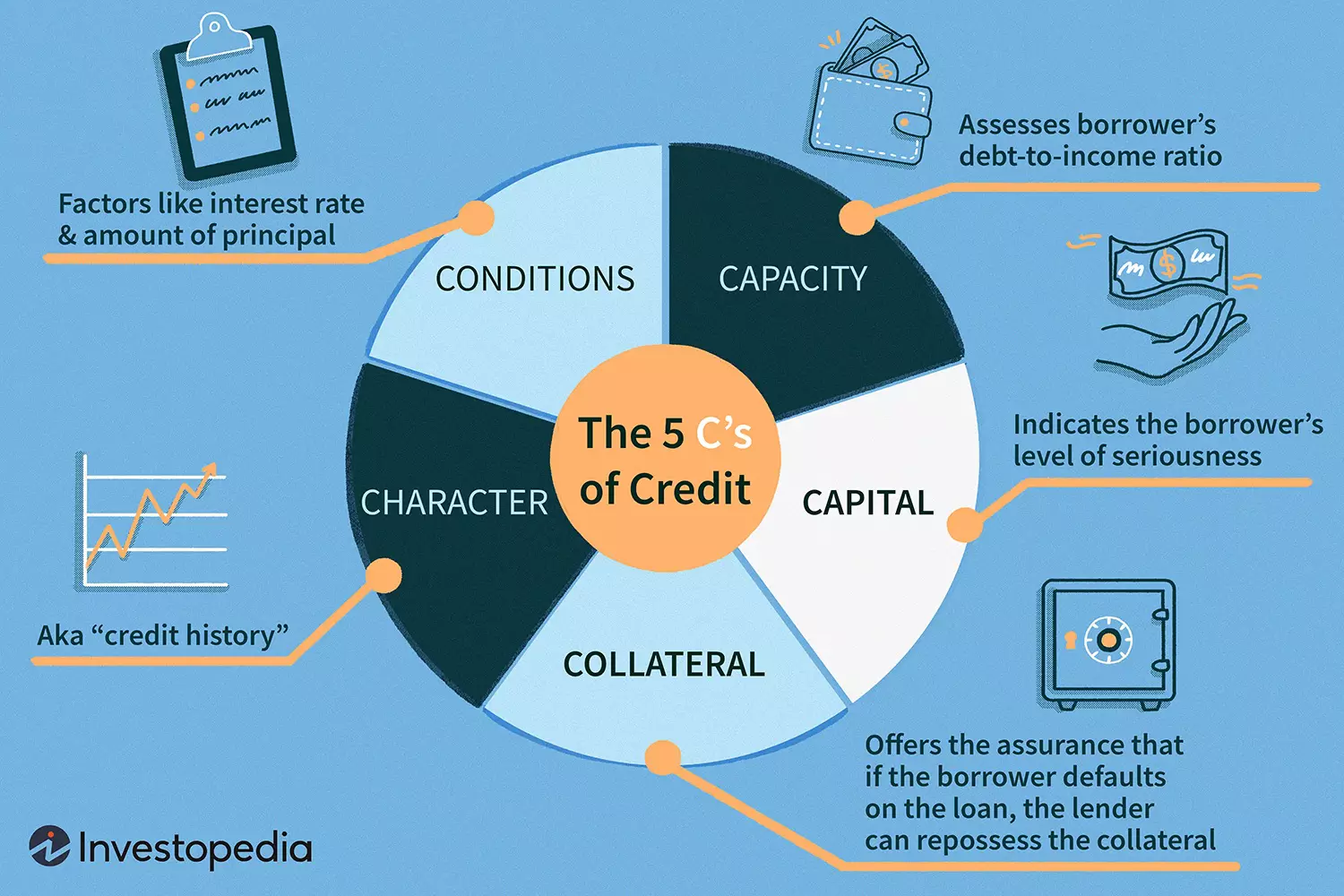

The five “C's” of credit are simply a way that lenders evaluate the risk of loaning you money. This system helps them predict whether potential borrowers will be able to repay the loan — and whether to expect turbulent times or calm waters ahead.

Character

How is your credit history? Do you have a track record of consistently making payments on time? Have you ever declared bankruptcy?

Lenders will look at your credit history to see how trustworthy you are. Check your credit score regularly and make sure the information is accurate. Setting up automatic, recurring payments can be a lifesaver, ensuring that your bills are paid on time.

Capacity

Can you pay back the loan? How much debt do you already have, compared to your income?

A lender will want to see a history of consistent income. Although switching jobs may result in higher pay, changing your job too frequently can be a sign of instability. And as always, keep making regular payments on any loans you already have in order to reduce your debt.

Capital

How much money do you already have?

Lenders look at how much money you can commit toward a potential investment (like the down payment on your home). They know that a larger contribution by you, up front, increases the chance that you’ll keep making your loan payments. As you save, make sure your funds are safely stowed in an interest-bearing savings or investment account so that they’ll grow at a faster rate.

Collateral

What property or possessions can you pledge as security against the loan?

Collateral helps a borrower get a loan. It assures the lender that if you fail to make payments on your loan, then the lender can get something back by repossessing the collateral. The collateral is often the object you’re borrowing the money for: Car loans are secured by cars, and mortgages are secured by homes. For other types of loans, make sure you have assets that you can use as collateral, and remember that the bank is only entitled to these assets if you fail to make the loan payments.

Conditions

What is the purpose of the loan? How much money do you need? How will current interest rates affect your loan?

In addition to examining your income, lenders look at the general conditions relating to your loan. Some conditions are factors outside your control: the state of the economy and current interest rates, for example. Do your best to make sure the factors in your control, like length of employment and job stability, work in your favor.

These are the main considerations lenders used to approve you for your mortgage. They’ll also continue to look at these criteria when you refinance, apply for a car loan or business loan, or any other type of loan.

Your “C’s” don’t have to be stormy: Understanding how lenders consider who to loan to can ensure smooth sailing ahead. They can also help you navigate any obstacles to ensure your credit history is a strong one.

More resources: