Keeping Score: Why Monitoring Your Credit is Important

January 22, 2024

Your school days may be in the past, but did you know you’re still being graded?

If you haven’t been monitoring your credit score, then the new year is a great time to start. Paying attention to this number is a vital part of your financial responsibilities for three major reasons:

- Your credit score can affect your ability to buy a home, car, or other large purchase.

- Your credit score can affect your ability to get a job: Employers may check your credit to see how well you handle money.

- Your credit score can show you if you’ve been a victim of identity theft.

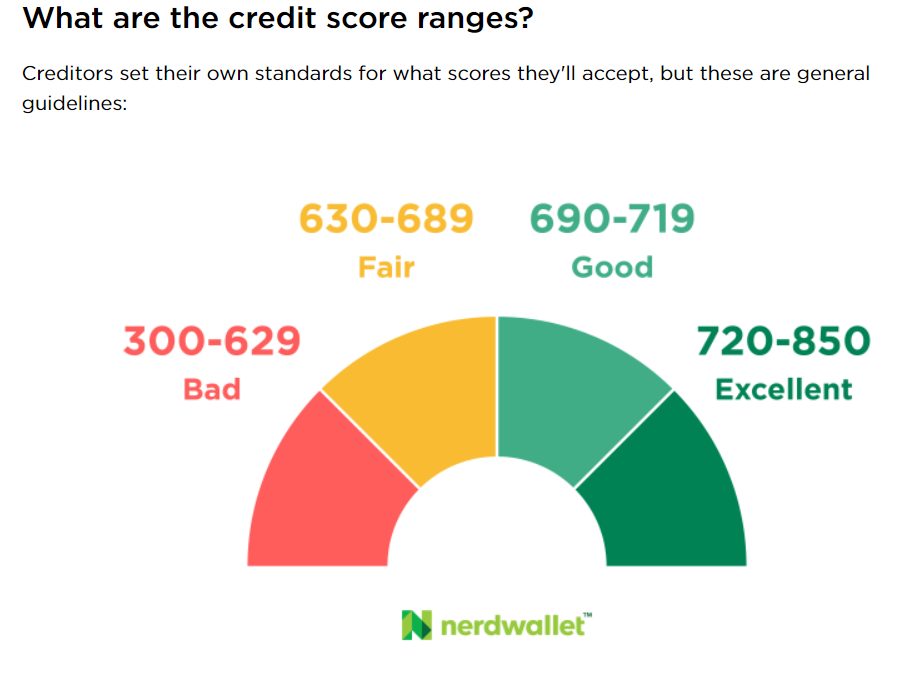

Your credit score is a three-digit number between 300 and 850. The higher this number is, the better. It tells lenders, employers, landlords, and others how likely you are to repay your debt.

There are three credit bureaus in the United States: TransUnion, Equifax, and Experian. They record information like late or missed payments, bankruptcies, foreclosures, and the amount of debt you have compared to your available credit. Your scores from these three agencies make up your FICO credit score.

You can see your FICO score by downloading your free credit report from the Federal Trade Commission (FTC) through annualcreditreport.com. This will show you any new accounts opened, the balances on your cards and loans, and any missed payments.

But what if you don’t like what you see?

First, check for errors. If you think your credit report contains a mistake, contact the credit bureau and the company that provided the incorrect information, and ask them to correct their records.

Second, there are four major steps you can take to raise your score:

- Pay all bills on time.

- Keep credit card balances under 30% of their limits, and ideally much lower.

- Keep older credit cards open to protect the average age of your accounts, even if you no longer use the cards.

- Space out credit applications instead of applying for several close together.

This process of repairing and rebuilding your credit takes time. But making the effort to boost your score is worth the work – it’s an investment in yourself and your financial future.